Overview - An online platform for brokers to get a quote and understand the likelihood of the bank approving the loan based on their client's finances.

My role - UX/UI design, workshop facilitation, user research.

With a heavy reliance on manual processes, each case submitted by a broker needed a broker development manager (BDM) to review it. Two out of three cases would be outside of the bank's lending appetite, resulting in inefficiencies.

It could take up to 24 hours to provide the customer with a response (or longer if their BDM was out of the office).

Solving both problems would allow us to become more efficient. More importantly, it would give brokers an incentive to do more business with the bank

Using design thinking I ensure the focus is on the customer. I find their pain points and unmet needs to deliver true innovation for our customers.

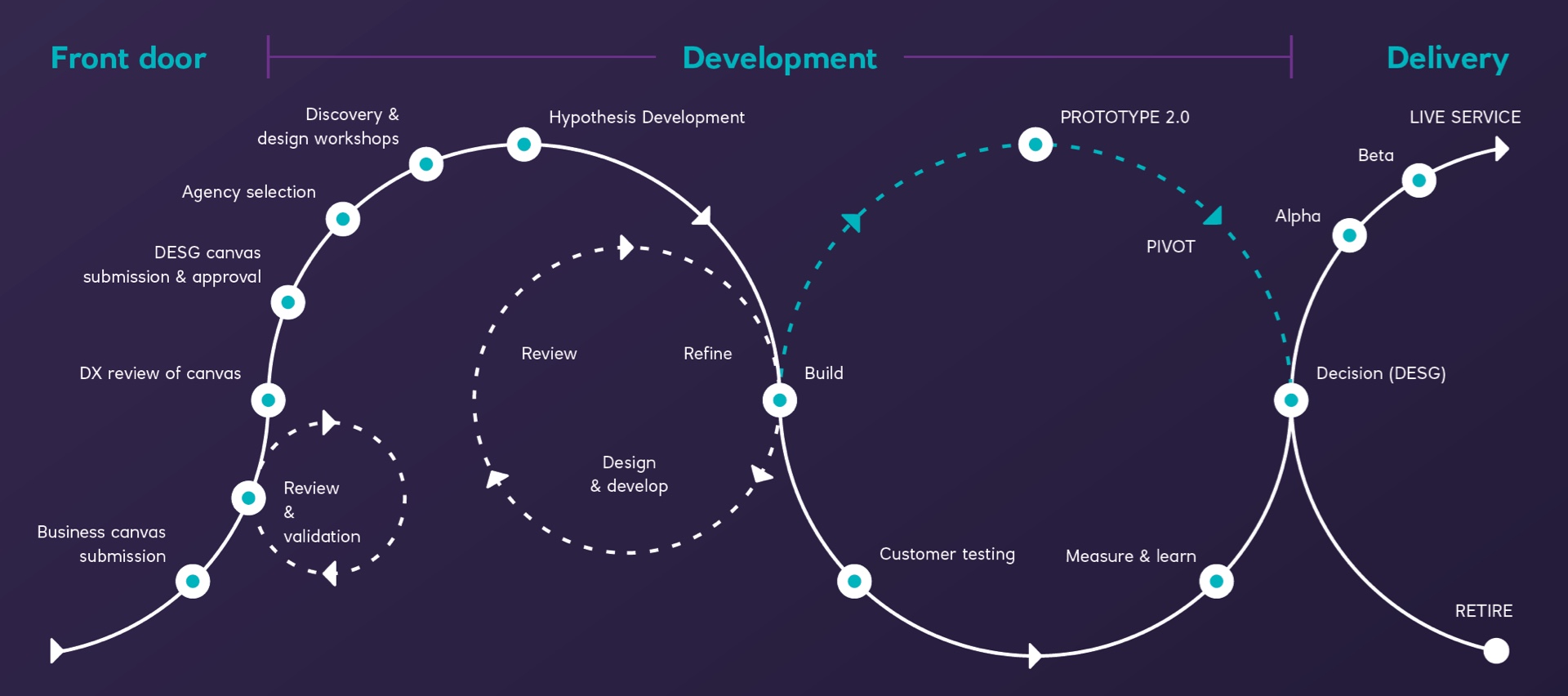

The RAD process delivers functional coded prototypes over a six to eight week period. The solution goes through an alpha and beta before proceeding to a live service. We use a continuous development model, developing solutions with our customers. They interact with working prototypes, using real data in natural environments.

We apply a three lens approach to this process. This allows us to understand the problem from the perspective of the customer, market segment, and the bank‘s objectives. This highlights scope for innovation to benefit each area.

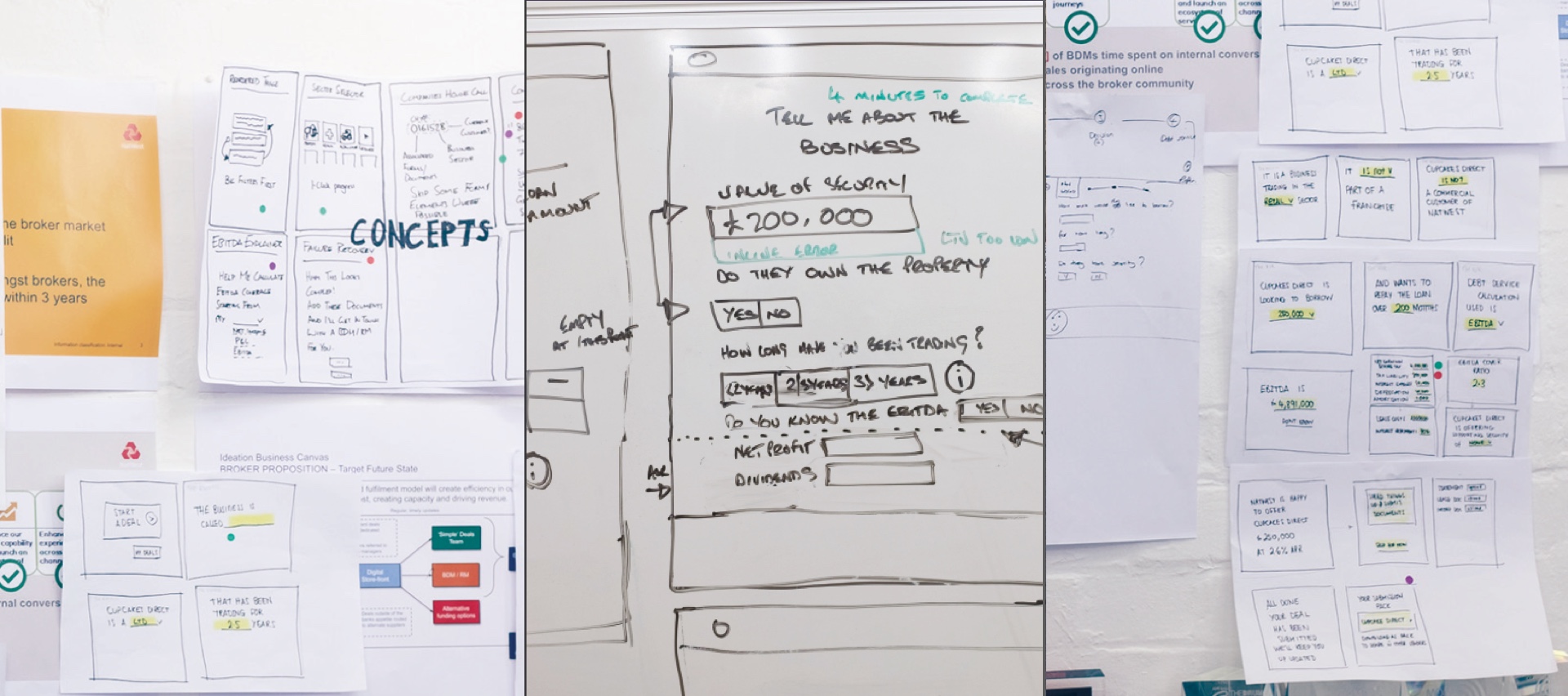

In the first week of the project, we use the structure of a Google design sprint. This is a process used to answer critical business questions through design, prototyping and testing ideas with customers. In this instance – we were trying to understand if brokers were open to a significant behavioural change and if this could be fulfilled digitally.

By working together as a squad, we cut out the debate cycle and compressed months of work into one week. This allowed us to fast forward into the future and gauge brokers reactions before making costly commitments.

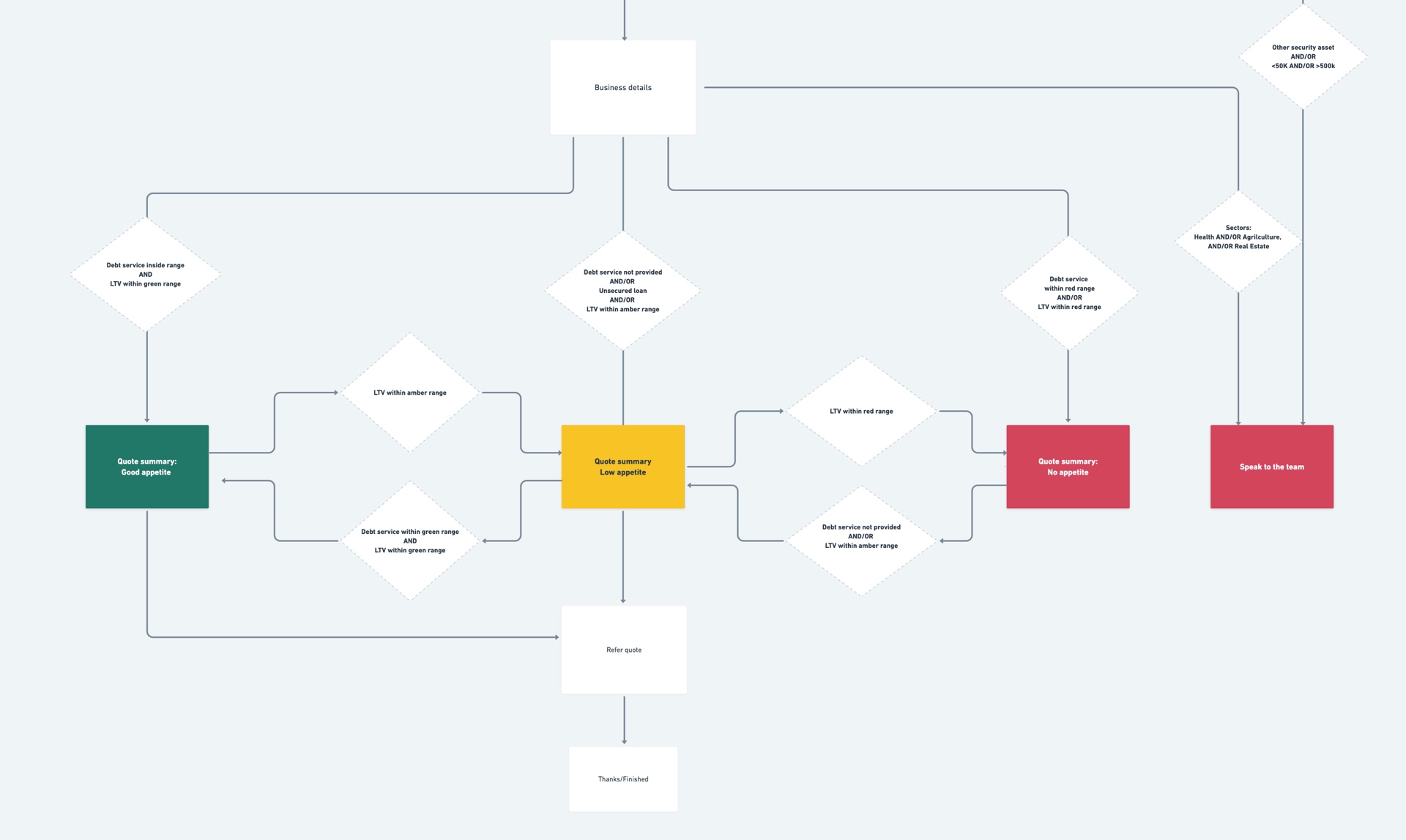

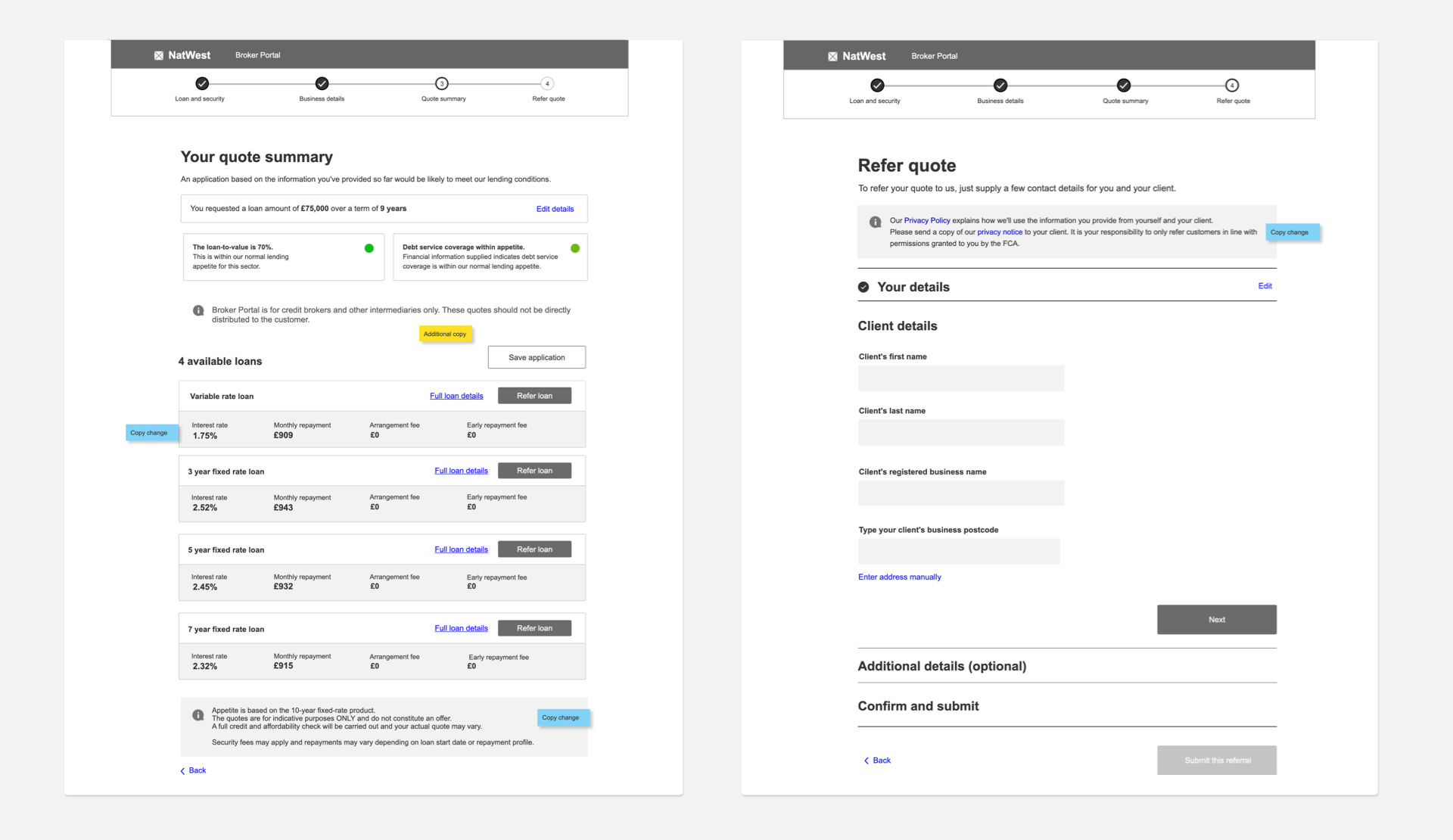

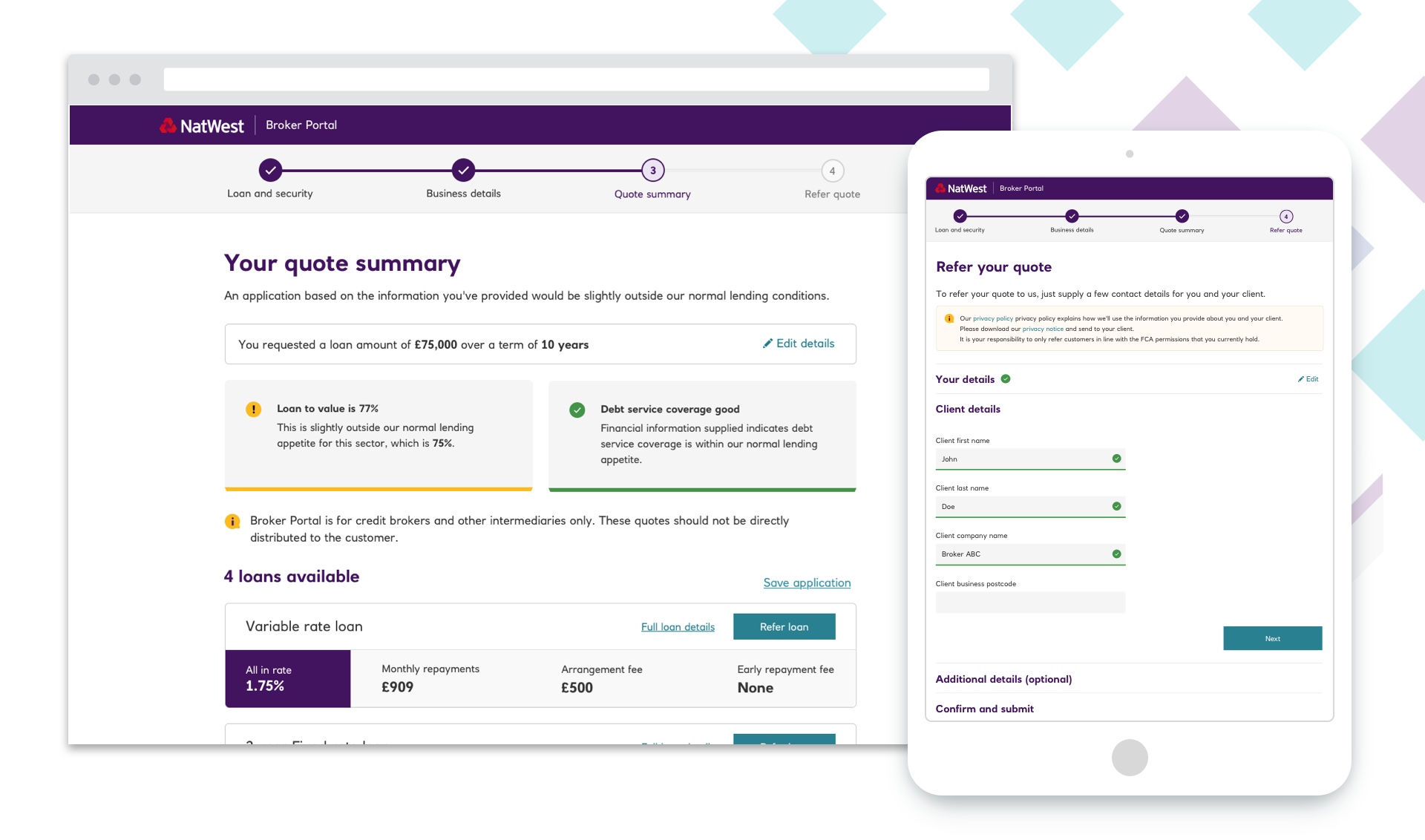

My approach to design starts from the outset, progressing from paper sketches to low fidelity prototypes. I used these to solve the key challenges:

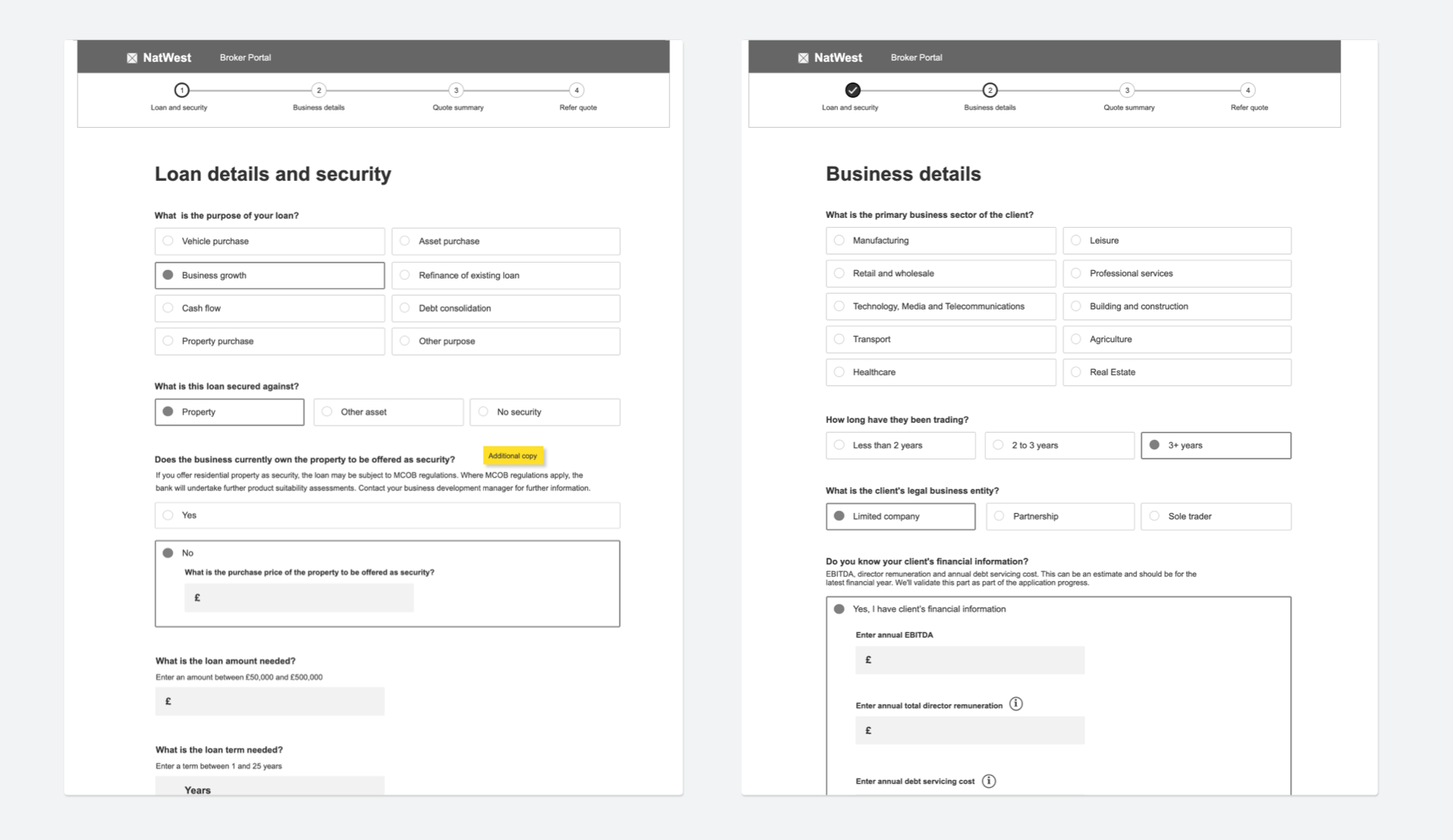

I used the knowledge gained during discovery and research to develop a low fidelity prototype. As we progressed, I moved into a UI design phase. Using NatWest branding, typography and colours, I then produced high fidelity designs of the final product. Throughout, I collaborated with the development team to build a robust digital journey.

We conducted remote testing plus face-to-face sessions with 30 brokers over three rounds. Through testing, we gained insights that were crucial to achieving a successful outcome:

NatWest Property Finance Direct